Write Off Fixed Asset

Divide by 12 to tell you the monthly depreciation for the asset. Likewise the journal entry for fixed asset write-off is required to make sure that the asset is completely removed from the balance sheet.

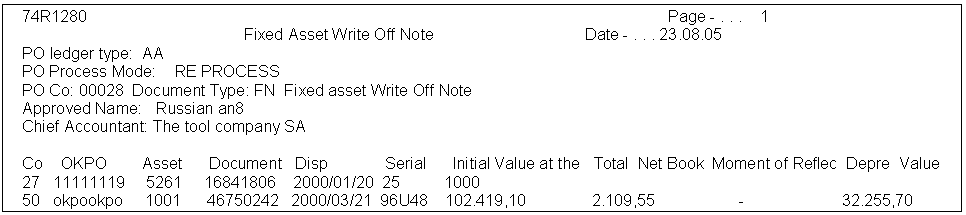

Work With The Fixed Asset Write Off Note

Thus a write off is mandated when an account receivable cannot be collected when inventory is obsolete when there is no longer any use for a fixed asset or when an employee leaves the.

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

. Politics-Govt Just in time for US. Add the write off amount to your depreciation costs on the profit and loss. First off lets create a Fixed Asset account for a vehicle.

During revaluation in March 2018 the asset appreciated by 20. NW IR-6526 Washington DC 20224. A write-down on the other hand reduces the book value of an asset when its carrying value exceeds fair value carrying value purchase price accumulated depreciation.

Writing-off brings down the value of an asset to zero. A Fixed Asset Is of No Use. Divide this amount by the number of years in the assets useful lifespan.

Success will let businesses reap the benefits of the technology. The distinction is that while a write-off is generally completely removed from the balance sheet a write-down leaves the asset with a lower value. This represents your small businesss obligations to pay debts owed to lenders suppliers.

A write-off of fixed assets includes removing the traces of fixed assets from the balance sheet. Click Save and Close. For example if you bought a car worth 10000 over time it has depreciated in value by 8000 and is now worth just 2000.

A variation on the first situation is to write off a fixed asset that has not yet been completely depreciated. Senate race border wall gets a makeover. For example the market value of a fixed asset may now be half of its carrying amount so you may.

Useful life of the asset. As an example one of the consequences of the 2007 subprime crisis for financial institutions was a revaluation under mark-to-market rules. Accounts payable is a business finance 101 term.

From the Account drop-down select New. Heres the information you need to calculate depreciation. Were going back to the basics in accounting and the objective of this post is to walk you through the correct way to book a fixed asset journal entry and how to do fixed asset accounting all the way from a new asset purchase to sale and write offWhether youre a bookkeeper or accounting clerk or an experienced staff accountant or CPA its worth.

Hence all these assets are not included while computing fixed assets. Whirlpool Refrigerator Led Lights Flashing. And write-off also specifically refers to removing or derecognizing the asset from the fixed assets register and statement of financial position at.

The write off process involves the following steps. Example 2 Fixed Asset Account. If the result of the revaluation transaction is a revaluation surplus but an asset impairment write-off has previously been allocated to the income statement for the particular asset.

Fixed assets are items of value to a company that wont be used up within a year and are intended for long-term use. And Microsoft has fixed a total of 75 bugs. A mortgage in itself is not a debt it is the lenders security for a debt.

This is done to reduce the related fixed assets account and accumulated fixed assets account. Modzy and Snowplow are among the early-stage companies aiming to move AI from science project to enterprise asset. The machine was ready to use during May 2016 but actually put to use during June 2016.

Reduce the current value to zero on your balance sheet. The number of years you expect to use the asset. A write off occurs upon the realization that an asset no longer can be converted into cash can provide no further use to a business or has no market value.

In this situation write off the remaining undepreciated amount of the asset to a loss account. Prepare a fixed asset account for the useful life of the. The big and beautiful US-Mexico border wall that became a key campaign issue for Donald Trump is getting a makeover thanks to the Biden administration but a critic of the current president says dirty politics is behind the decision.

A fixed asset is a tangible piece of property plant or equipment PP. Go to the List menu then select Chart of Accounts. We welcome your comments about this publication and your suggestions for future editions.

Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. Enter a name and description of the vehicle then enter all other details of the newly purchased vehicle. After switching to LEDs or when replacing a faulty LED lamp in some cases the LED light will start flickering We will explain temperature settings alarm sounds door not closing water filter changes not cooling issues not making ice no power strange sounds leveling ice makers water dispensers This refrigerator has the.

A fixed asset is also known as a non-current assetAn asset is fixed because it is an item that a business will not consume sell or convert to cash within an accounting calendar year. The result is the depreciable basis or the amount that can be depreciated. In accounting a write-off happens when an assets value is eliminated in the books.

Business and Finance Terms to Know. IT applications infrastructure and operations. A write off involves removing all traces of the fixed asset from the balance sheet so that the related fixed asset account and accumulated depreciation account are reduced.

Impairment majorly constitutes a reduction in the value of an underlying asset. Automated straight-line depreciation calculation. Get 247 customer support help when you place a homework help service order with us.

A fixed asset is written off when it is determined that there is no further use for the asset or if the asset is sold off or otherwise disposed of. Determine the Amount of the Write-Off. What Is a Fixed Asset.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Three UK to switch off 3G network in two years time. It is entirely possible that only a portion of the amount recorded on the books for an asset known as its carrying amount needs to be written off.

The term fixed however does not refer to the physicality of an asset. A company might buy furniture for their office however the company downsizes and the owner moves back to a. Inventory is a noncurrent asset.

To record the write off an asset in your accounts you. Fixed asset write-off is the way the company removes the fixed asset from its accounting record due to it determines that such fixed asset is no longer useful in the business. From accounting to business loans to general business financial operations heres the ultimate list to all the business finance terms and definitions you need to know.

Select an account type then click Continue. Fixed assets are not expected to be consumed or converted into. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

In order to record the reduction in the value of the asset the loss needs to be charged to the. The impaired amount is shown as a separate item in the income statement. Accounting Treatment for Impairment.

To use the same example ABC Corporation gives away the machine after eight years when it has not yet depreciated 20000 of the assets original 100000 cost. Use our fixed asset register template with an unlimited number of fixed asset classes and asset categories. Write off an asset.

A fixed asset is a long-term tangible piece of property that a firm owns and uses in its operations to generate income. Both concepts account for the loss of assets but the. There are two scenarios.

The journal entry above shows the write-off of an asset from the Balance Sheet. Washington Mutual will write down by 150 million the. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

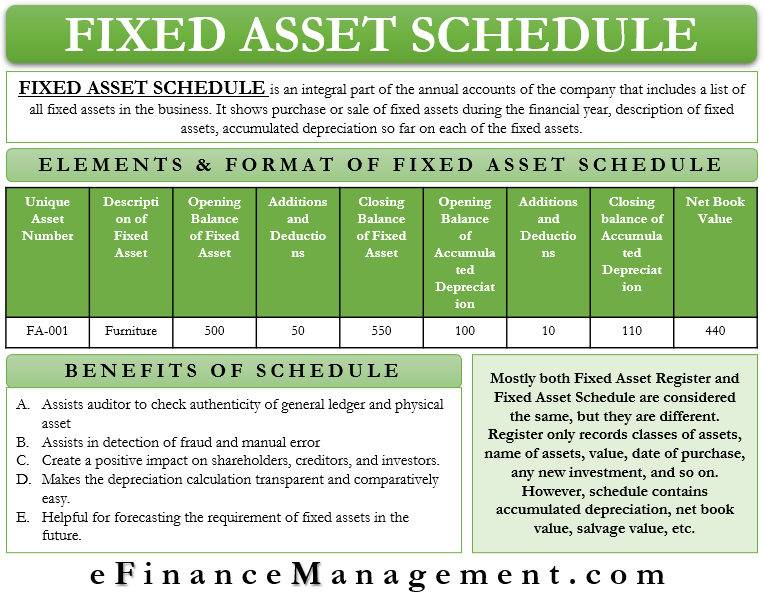

Fixed Asset Schedule Meaning Elements Format Benefits Conclusion Efm

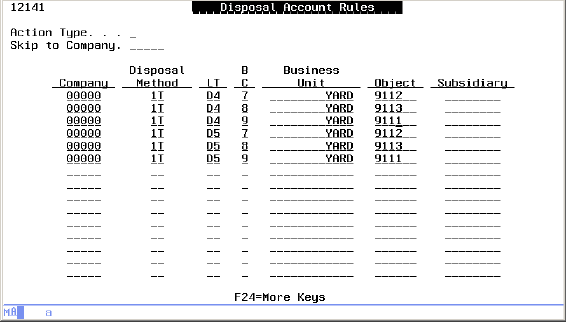

Netsuite Fixed Asset Management User Guide Netsuite Accounting

Work With The Fixed Asset Write Off Note

How Do I Remove A Fixed Asset An Old Vehicle That The Business No Longer Has From The Balance Sheet

:max_bytes(150000):strip_icc()/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

Comments

Post a Comment